Lucid Motors Gets Past Its Reverse Stock Split Selloff: Can LCID Still Go Higher?

/A%20Lucid%20Motors%20vehicle%20parked%20in%20front%20of%20a%20showroom_%20Image%20by%20Michael%20Berlfein%20via%20Shutterstock_.jpg)

Lucid Motors (LCID) reverse split its stock on Sept. 2, and the event wasn’t positive for the investors, as LCID stock expectedly fell after the event. While it is usual for stocks to fall on a reverse stock split, the severity of the sell-off took me by surprise.

However, LCID stock has gained 5% over the last five days and is now trading near the adjusted price level it traded a day before the reverse split. That’s a small consolation for investors, as the stock is still down 36% for the year. As for the stock’s long-term performance, the less said, the better, as, like fellow startup electric vehicle (EV) companies, it trades at a tiny fraction of the all-time highs.

To be fair, Lucid has managed to stay afloat (and relevant) at a time when companies in the U.S. startup EV ecosystem were going bankrupt pretty much left, right, and center. However, like other plays in the space—many of which eventually went out of business—Lucid has been on a stock-selling spree to fund its burgeoning losses.

Lucid Motors has the backing of Saudi Arabia’s Public Investment Fund (PIF), which has cumulatively invested around $8 billion in the company. For context, Lucid’s current market cap is just over $6 billion, which basically means that the company is not even worth the amount that the cash-rich fund has ploughed into it.

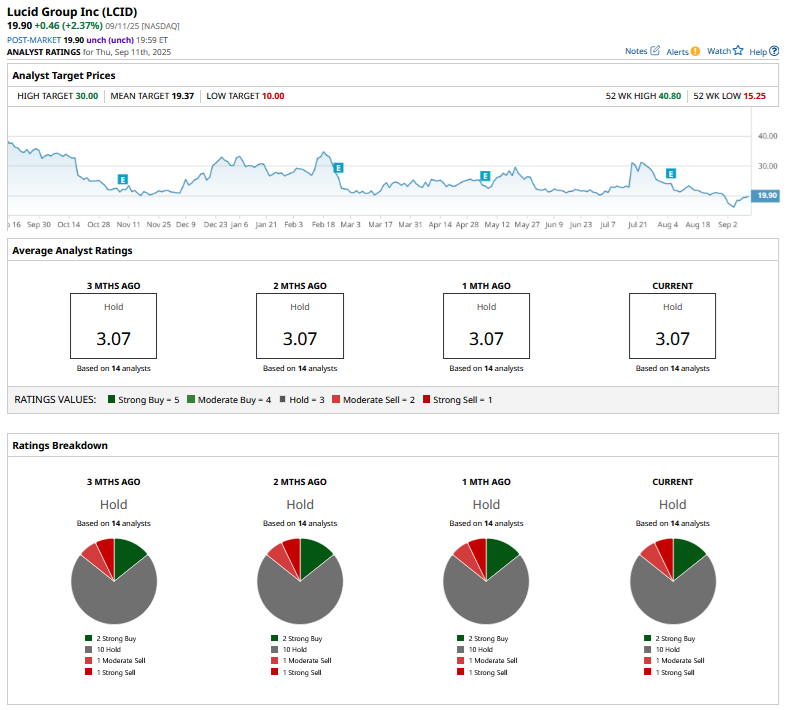

LCID Stock Forecast

Sell-side analysts are not too bullish on LCID, and it has a “Strong Buy” rating from only two of the 14 analysts covering the stock. Ten analysts rate it as a “Hold,” while one each rates it as a “Moderate Sell” and “Strong Sell.” LCID trades above its mean target price of $19.37, while the Street-high target price of $30 represents a potential upside of over 50% from the current price levels.

Analysts Are Bearish on EV Stocks

While brokerages were quite enthusiastic about EV stocks a couple of years ago, sentiment has soured given the changed macroeconomic environment. The EV story was built on the premise of faster adoption and supportive government policies. However, there are cracks on both the front, particularly the latter, with the Trump administration eliminating the EV tax credit, which prompted Tesla (TSLA) CEO Elon Musk to warn about a “few rough quarters.” Moreover, the One Big Beautiful Bill Act does away with penalties on automakers that do not meet emission standards, thereby effectively ending EV companies’ booming regulatory credit business. Trump’s tariffs have also been a headwind for automakers, and Lucid took a tariff hit of $54 million in Q2.

U.S. EV adoption rates have also been disappointing, even as China has raced ahead, in part due to supportive government policies. One opportunity for names like Lucid and Rivian (RIVN) is that Tesla is losing market share in the U.S., apparently over Musk’s political antics, which could turn some buyers to them. However, so far, we don't see customers rushing in to buy Lucid cars even as many shun Tesla.

Can LCID Stock Go Any Higher?

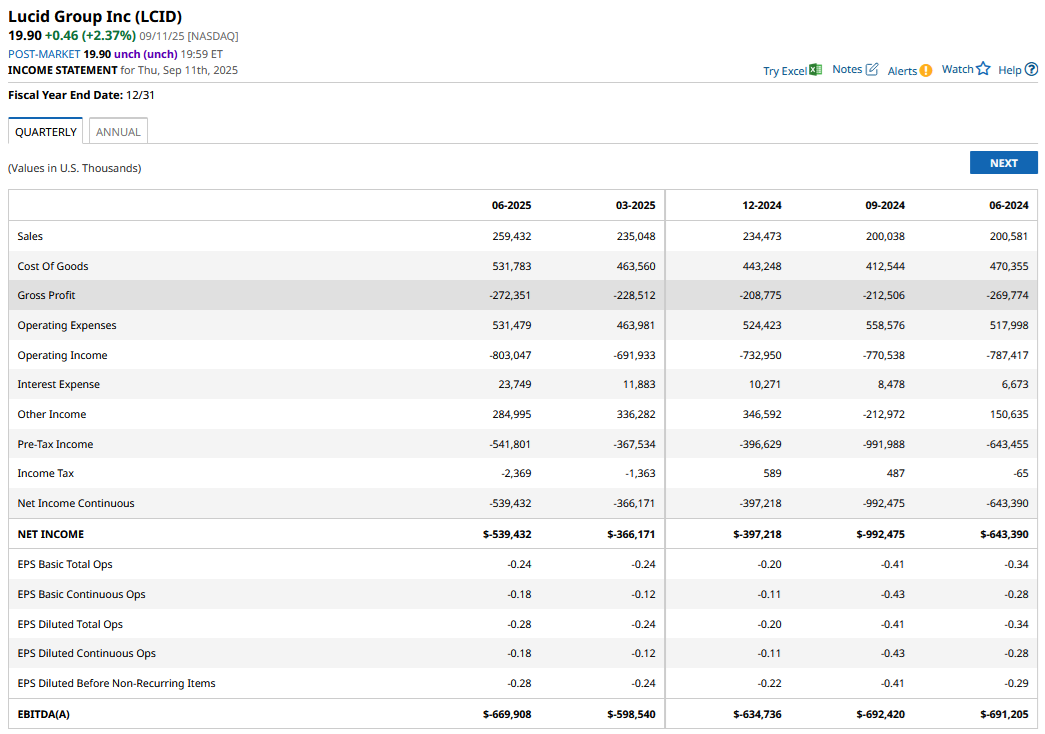

Lucid has to turn into a sustainable business sooner rather than later, as the unending cycle of stock sales to fund cash burn cannot continue in perpetuity. It took Lucid twice as much to build a car in Q2 as it sold it for—and we haven’t yet accounted for depreciation and other overheads like marketing expenses. As things stand today, Lucid does not have a well-defined short-term path to profitability.

Lucid Motors has to increase its deliveries significantly, as it's just about impossible to turn a corner with such dismal capacity utilization. That said, we should see Lucid’s deliveries scale up over the next couple of years as it launches more affordable models, including the upcoming midsize platform.

Uber (UBER) also partnered with Lucid in a three-way partnership with Nuro, wherein the ride-hailing giant will buy at least 20,000 Lucid cars fitted with Nuro’s autonomous driving system, which it will deploy in its robotaxi fleet. Saudi Arabia has the option to purchase up to 100,000 vehicles from Lucid, which, if completed, would help buoy the company's deliveries.

Lucid is also looking at partnerships of the kind it has with Aston Martin (ARGGY), wherein the luxury carmaker buys electric motors and batteries from the EV startup. Such deals would help Lucid improve its margins and aid its path towards becoming a sustainable business.

All said, while the U.S. EV industry is currently witnessing turmoil, to say the least, at these price levels, I find LCID's risk-return reasonably attractive and continue to stay put in the stock.

On the date of publication, Mohit Oberoi had a position in: LCID , RIVN , TSLA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.