IDEX Corp Stock: Is Wall Street Bullish or Bearish?

/Idex%20Corporation%20logo%20and%20chart%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

IDEX Corporation (IEX) is a global industrial company headquartered in Northbrook, Illinois. It operates through a network of specialized business units, delivering engineered solutions across various industries. The company is organized into three main segments: Fluid & Metering Technologies, Health & Science Technologies, and Fire & Safety/Diversified Products.

Its products include precision pumps, flow meters, fluid handling systems, optical components, and emergency response equipment. IDEX serves diverse sectors, including life sciences, semiconductors, energy, agriculture, and public safety. Its decentralized structure allows for flexibility and innovation, enabling it to meet the complex needs of customers in niche and mission-critical markets. The company has a market capitalization of $12.50 billion.

The company’s stock has not exactly been the best performer on Wall Street. Over the past 52 weeks, the stock has declined by 18.6%, while it is down by 20.7% year-to-date (YTD). The stock has broadly underperformed the S&P 500 Index ($SPX), which has gained 15.1% and 9.9% over the same periods, respectively.

The overall industrial sector has also been performing better than the stock. The Industrial Select Sector SPDR Fund (XLI) has been up 18.6% over the past 52 weeks and 16.3% this year.

On July 30, IDEX reported record sales of $865.4 million for the second quarter of fiscal 2025, implying a 7.2% rise from the prior year’s period. This was also higher than the $857.2 million that Wall Street analysts were expecting. However, its bottom-line financials showed weakness. Its EPS dropped from $1.86 in Q2 2024 to $1.74 in Q2 2025. However, its adjusted EPS grew marginally year-over-year (YOY) to $2.07. This figure was higher than the $2 that Wall Street analysts were expecting.

Despite the earnings beat, the company’s stock declined by 11.3% intraday on July 30. This was because IDEX cut its full-year forecast, as macroeconomic uncertainties will likely cause its customers to take a more cautious stance on spending.

For the fiscal year 2025, ending in December 2025, Wall Street analysts expect IDEX’s EPS to grow marginally YOY to $7.90 on a diluted basis, and increase by 9.1% to $8.62 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all of the trailing four quarters.

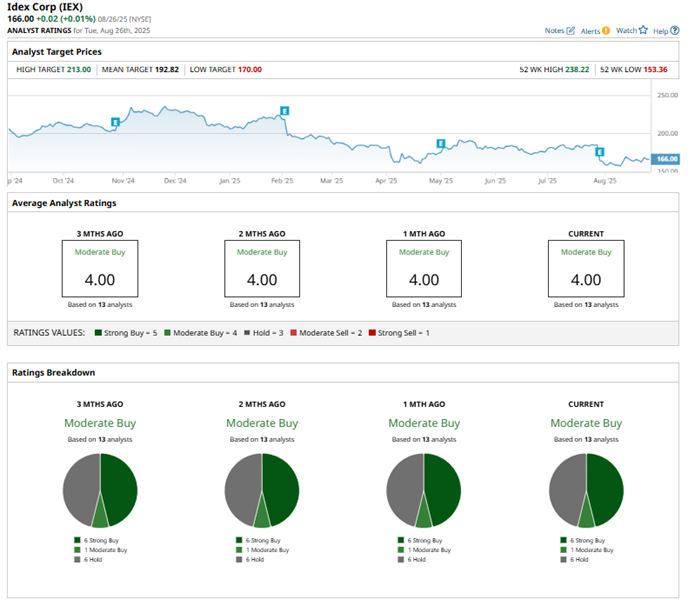

Among the 13 Wall Street analysts covering IDEX’s stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, one “Moderate Buy,” and six “Hold” ratings.

The configuration of the ratings has remained relatively stable over the past three months.

This month, analysts at DA Davidson maintained a “Neutral” rating on IDEX’s shares. However, they cut the price target from $215 to $180, citing “incremental customer tentativeness” regarding inbound orders.

IDEX’s mean price target of $192.82 indicates a 16.2% upside over current market prices. The Street-high price target of $213 implies a potential upside of 28.3%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.