Generac Holdings Stock Outlook: Is Wall Street Bullish or Bearish?

/Generac%20Holdings%20Inc%20portable%20generator%20by-%20Lissandra%20Melo%20via%20Shutterstock.jpg)

With a market cap of $11.7 billion, Generac Holdings Inc. (GNRC) is a leading global designer and manufacturer of energy technology products and solutions. The company offers a broad portfolio ranging from residential, commercial, and industrial power generation equipment to energy storage systems, smart home solutions, and distributed energy resource management platforms.

Shares of the Waukesha, Wisconsin-based company have outperformed the broader market over the past 52 weeks. GNRC stock has climbed 29.6% over this time frame, while the broader S&P 500 Index ($SPX) has returned 14.4%. Moreover, shares of the company are up 27.1% on a YTD basis, compared to SPX’s 8.9% gain.

Focusing more closely, the generator maker stock has also outpaced the Industrial Select Sector SPDR Fund’s (XLI) 18.7% increase over the past 52 weeks.

Shares of Generac Holdings jumped 19.6% on Jul. 30 after the company posted better-than-expected Q2 2025 results, with adjusted EPS of $1.65 and revenue of $1.06 billion. Strong demand for home standby generators drove a 6.6% rise in residential sales, boosted by shipments to Puerto Rico, while its commercial and industrial segment grew 5.2% year-over-year.

For the fiscal year ending in December 2025, analysts expect Generac Holdings’ adjusted EPS to grow 4.4% year-over-year to $7.59. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

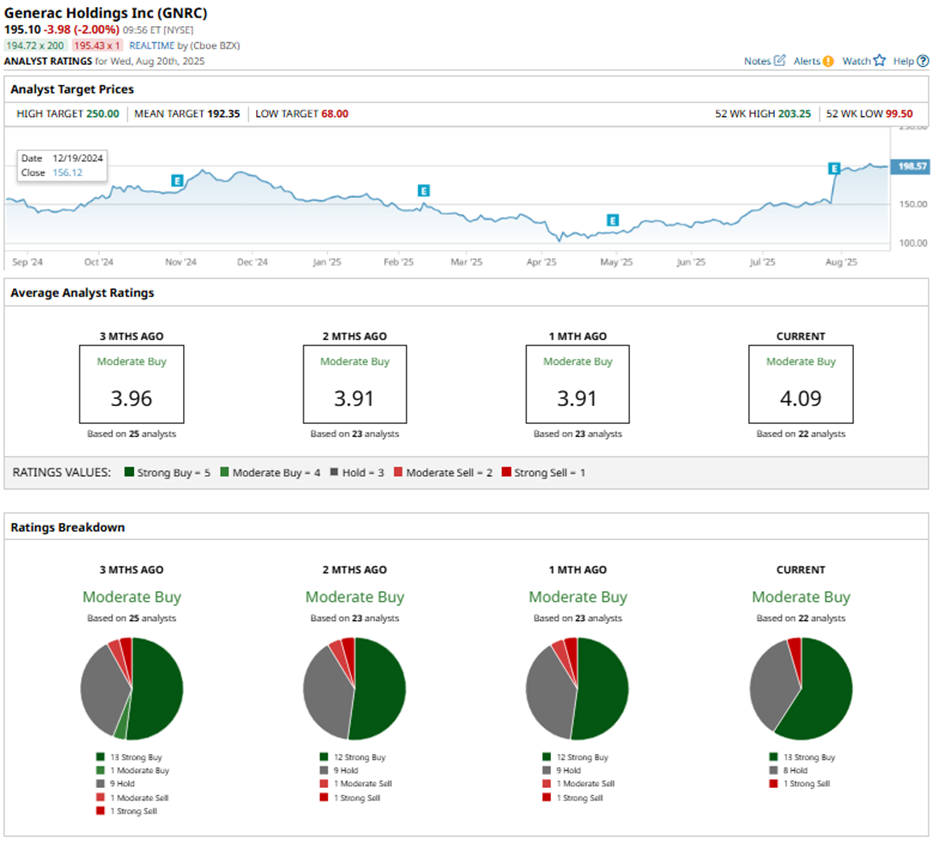

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, eight “Holds,” and one “Strong Sell.”

On Jul. 30, J.P. Morgan analyst Mark Strouse reiterated a “Hold" rating on Generac Holdings and set a price target of $165.

As of writing, the stock is trading above the mean price target of $192.35. The Street-high price target of $250 implies a potential upside of 28.1% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.