WALSH PURE SPREADER -Pure Hedge Division -

WALSH PURE SPREADER

-Pure Hedge Division -

Rich Moran 7/30/2025

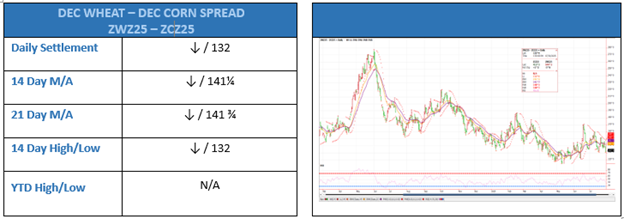

DEC’25 WHEAT-DEC’25 CORN SPREAD (ZWZ25-ZCZ25)

The Dec Wheat - Dec Corn Spread (ZWZ25-ZCZ25) settled today at 132 ($1.32), matching its 14-day low from July 18th. This is below the 14-day and 21-day moving averages. As long as we can stay below these moving averages, I like being short this spread. The parabolics have also been bearish since the middle of July.

I have been looking for a way to include some corn longs in a spread position in case there is a correction in the corn market. The general direction of the ZWZ25-ZCZ25 spread has been downward sloping since making its 52-week high of 219 on 10/3/24. It settled 211 that day. As both wheat and corn were trending higher at the end of 2024 and beginning of 2025, the spread was trending lower. Since then, both commodities have reversed to downward trends and the spread has continued to trend lower.

As of Friday’s Commitments of Traders Summary, managed money is still short 177,365 corn futures and 52,041 wheat futures. When considering/comparing open interest levels and volume levels of corn and wheat, the managed money shorts are relatively similar.

Another thing to consider is if we continue with more trade deals, both wheat and corn may go higher. If this happens, I think corn could win the race up versus wheat, resulting in more downward pressure on this wheat-corn spread. “The trend is your friend …. until the end.” I feel we may some time before this trend is over.

I suggest getting short tomorrow on the opening at today’s settlement (132) or higher.

Risk 20 cents or $1,000 to make 50 cents or $2,500.

Following up on past trade ideas:

7/23/25: ZWZ25-ZWH26(DEC’25-MAR’26 WHEAT SPREAD)

Today’s Settlement: -17¾, Long at -18½

Risk 3½ cents (-22) or $175 Per Spread to make 10 cents (-8½) or $500 Per Spread.

- 7/18/25: ZLZ25-ZLH26 (DEC’25-MAR’26 Soybean Oil Spread)

Today’s settlement: +0.18, Long at +0.15

Risk 0.30 cents (0.15) or $180 to make 0.90 cents (+1.05) or $540

- 7/16/25 (6/20/2025): ZCU25-ZCZ25 (SEP-DEC’25 Corn Spread)

Today’s Settlement: -20½, Short at -17½

Risk 3½ cents (-14) or $175 to make 8.5 cents(-26) or $425

- 7/9/2025: (LEG26x2)-GFQ25-ZCU25:

(FEB’26 Live Cattle x 2, AUG ’25 Feeder Cattle, SEP ’25 Corn – Cattle Crush Spread)

Today’s Settlement: -271.60, Still looking to get short and waiting to settle below the 14-day and 21-day moving averages.

- 7/2/25: 7/2/2025: ZMQ25-ZMZ25 (AUG-DEC’25 Soybean Meal Spread)

Today’s Settlement: -13.8, Still looking to buy this spread if it settles above the 14-day and 21-day moving averages. It did settle above the 14-day moving average, but it still settled below the 21-day moving average today.

If you have any thoughts/questions on this article or any questions at all in regard to the commodities futures markets, please use this link Sign Up Now

Rich Moran

Senior Commodities Broker

Direct: (312)985-0298

Cell: (773)502-5321

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.